[et_pb_section fb_built=”1″ _builder_version=”4.0.9″][et_pb_row _builder_version=”4.0.9″][et_pb_column type=”4_4″ _builder_version=”4.0.9″][et_pb_text _builder_version=”4.0.9″]

Invest Wisely in High-Value Home Insurance

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”4.0.9″][et_pb_column type=”4_4″ _builder_version=”4.0.9″][et_pb_text _builder_version=”4.0.9″]

You’ve had the good fortune of experiencing financial success in your life, and you’ve invested a great deal of it in your home. But when shopping for homeowners insurance, you may find that standard policies don’t quite meet your needs.

You’ve worked hard to build high-value estate complete with expensive furnishings and other valuables, and you deserve a specialized policy designed to cover your investments.

What Is High-Value Home Insurance?

In short, high-value home insurance is a policy that provides all the coverage offered by traditional homeowners insurance, and then goes above and beyond.

Allowed coverage limits in each category are much higher than with traditional homeowners policies, which makes this type of policy perfect for individuals with luxury estates. The value of your home and possessions is factored into your specific policy.

Obviously, all homes (and the possessions within) have different total values, and your personal estate will demand coverage needs tailored specifically for you. Your policy will even provide coverage in the event that your home is badly damaged and needs to be rebuilt — up to its original value.

Why Traditional Homeowners Insurance Policies May Not Be Enough

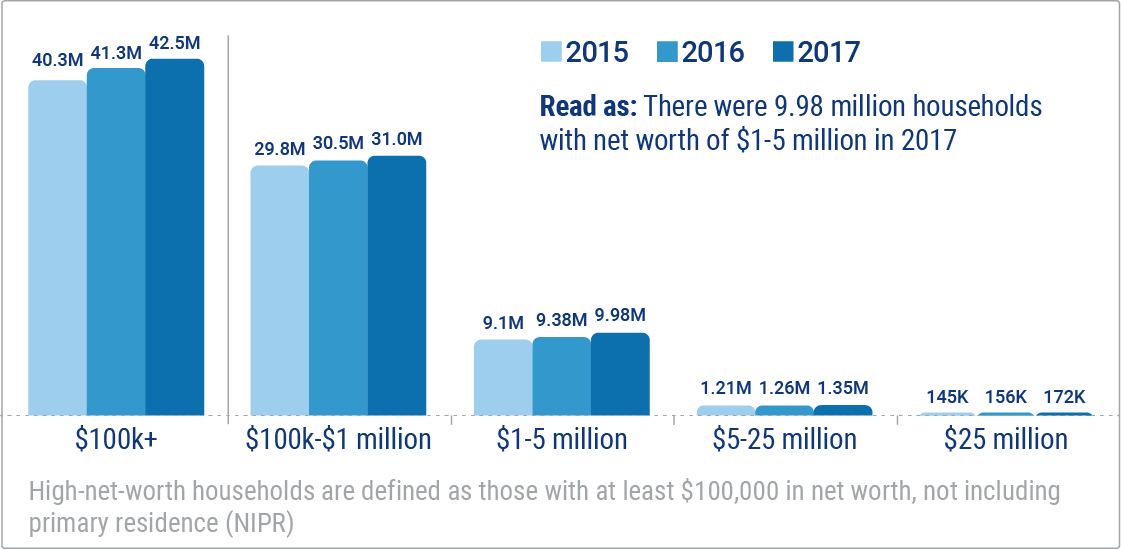

The Number of High-Net-Worth Households in the US

Beyond just understanding that typical homeowners insurance policies may not be enough to meet your unique needs, it’s helpful to see the specific breakdown of where they might come up short.

- Traditional homeowners policies typically place caps of $1,000 to $2,000 each on coverage for items such as furs, silver, jewelry, and fine art.

- Purchasing separate riders on these items may only increase your full coverage to $10,000 for each category of personal belongings.

- Homeowners policies typically limit the cap on contents coverage at 50% to 70% of your home’s value — usually not enough for high-wealth individuals and collectors.

Basically, a high-value home insurance policy helps to fill in the gaps that would be left by a traditional homeowners insurance policy. When dealing with potentially replacing or repairing luxury estates and valuables, these are gaps you can’t afford not to fill.

How Is High-Value Home Insurance Different?

High-value home insurance addresses the issue of coverage needs that extend beyond the coverage caps locked on to numerous categories by traditional homeowners insurance policies.

With high-value home insurance, the need to purchase separate endorsements or insurance riders in order to cover the additional value is eliminated.

| Typical limits for high-value items in standard home insurance | |

| Jewelry | $1,500 |

| Furs | $1,500 |

| Photo & Video Equipment | $1,500 |

| Musical Instruments | $2,500 |

| Silverware | $2,500 |

| Golf Equipment | $2,500 |

| Fine Art | $2,500 |

| Computer/Electronic Equipment | $1,500 |

| Postage | $1,500 |

| Stamps | $1,500 |

| Coins | $200 |

| Firearms | $2,500 |

| Bikes | $1,500 |

Individuals with an extensive list of luxury items requiring higher coverage amounts can get all their needs met, wrapped up in one neat and tidy policy. To make matters even better, having a single policy without extraneous endorsements or riders will ultimately save you money.

What Constitutes a High-Value Home?

High-value home insurance sounds great, but how do you determine if your home is a candidate for this type of policy? Well, some insurance companies offer high-value policies for homes valued at $300,000 or more, but most won’t insure homes under $750,000 in value. Some policies even begin at the $1 million mark when it comes to estate values.

Keep in mind that home values vary throughout the country, and that insurance companies differ in their coverage requirements. You’ll need to shop around to find the best policy, since not all the available options will apply to your unique needs.

Why Do Luxury Homes Need Special Insurance?

Now that we’ve covered how high-value home insurance differs from standard homeowners insurance, it’s important to determine why luxury homes need to be insured in the first place. Here are just a few reasons why luxury estate owners should look into getting coverage:

- Luxury home owners may have hired staff (for cleaning, cooking, etc.) in addition to other guests in their home at any given time. With all these extra bodies in and around the estate, homeowners may rightfully be concerned about theft.

- Possessions that are higher-value are also highly attractive to burglars. In addition to loss due to theft, burglars may also cause damage to the home or property upon their intrusion, resulting in more financial loss.

- Luxury items that appreciate in value (i.e., custom stained-glass windows from Italy, a cellar stocked with fine wines from France, Persian rugs, etc.) may not have their full potential worth realized by standard homeowners insurance policies.

Only a high-value home insurance policy can recognize and honor the full value of your luxury estate and possessions.

In the event of a catastrophe that requires the replacement of your belongings or the rebuilding of your home, you’ll need an elite home insurance policy from a company that not only understands your unique coverage needs, but also values your items as much as you do.

Coverage Options for High-Value Home Insurance

Because high-value home insurance providers understand that your unique needs extend beyond traditional policies, they offer several options to choose from in order to create complete coverage designed specifically for you.

- Excess liability and umbrella liability coverage: These policies provide the full coverage necessary in the event that a lawsuit is filed against a high-value homeowner, including financial reimbursement for legal fees, fines, and restitution.

- Liability insurance for domestic help: Should one of your domestic help employees suffer an injury on the job, this coverage will take care of the medical expenses as well as lost wages while they are unable to work. This insurance also covers fees in the event that you are sued and deemed responsible for their injuries.

- Flood insurance: Homeowners insurance policies typically do not provide flood coverage. Floods can cause damage to your property and possessions, and water damage is one of the most common (and costly) home insurance claims across the board. Since typical flood insurance (provided by the National Flood Insurance Program) does not provide even close to enough coverage for luxury estates, high-value home insurance companies include it as part of their package.

- Identity theft insurance: Identity theft crimes are on the rise, and individuals with a high net worth are ideal targets for these criminals. This aspect of your insurance provides coverage for legal fees required to clean up the mess, and will potentially reimburse you for financial losses suffered while victimized.

- Kidnap and ransom insurance: Criminals also target high-net-worth individuals for prospective ransom payments. In the event of an incident, this coverage will help with costs required to meet the criminal’s demands, as well as for hiring the expert assistance necessary to resecure and protect your loved ones.

- Coverage for vacation homes: Many insurers also provide coverage for additional structures, including pool houses and vacation homes. Combining this coverage into one policy is a strategy to save money while maintaining the full coverage you need.

- Medical coverage for pets: Some high-value home policies even extend to pets. This coverage provides medical insurance policies to cover vet bills and possibly even boarding costs, should your home become temporarily uninhabitable due to a disaster.

How Do Insurance Companies Determine Property Values?

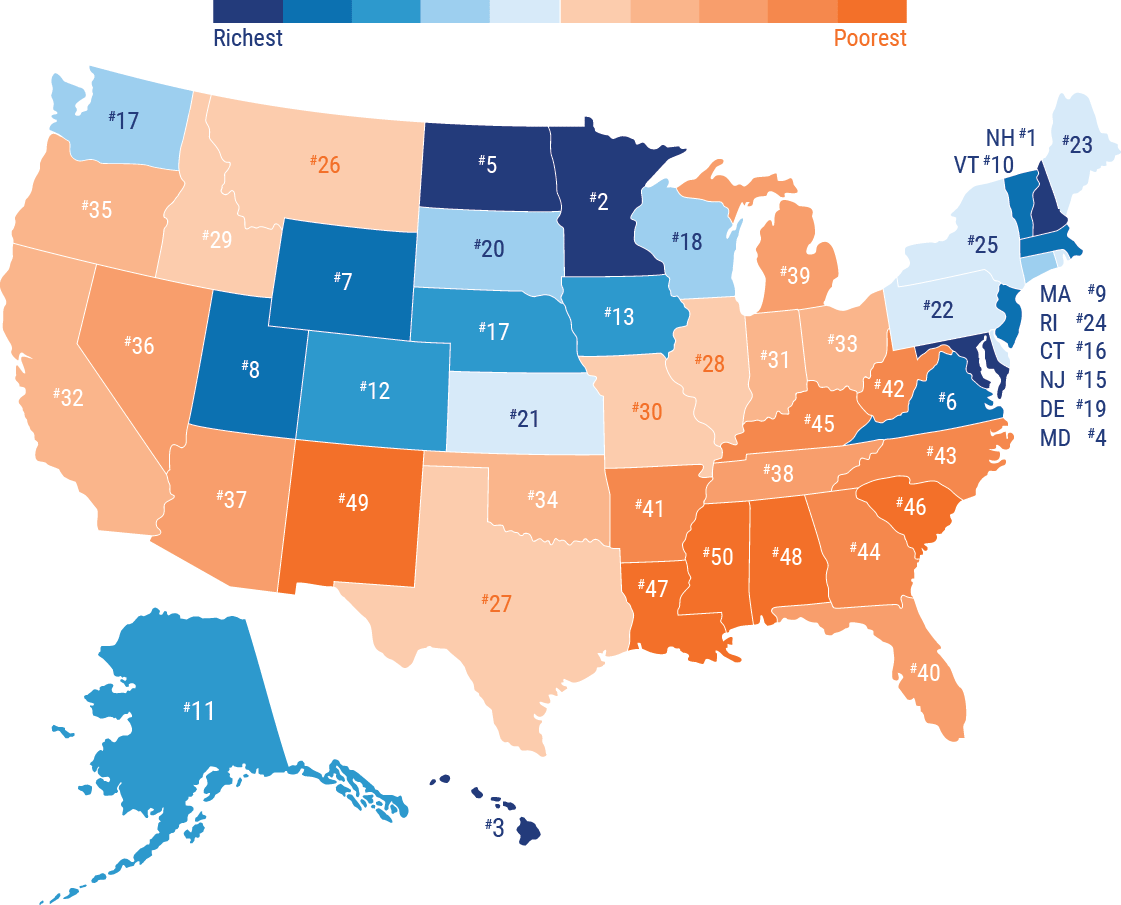

Richest States in America 2019

Typically, an insurance company will send out an expert appraiser to your estate to examine, assess, and document the value of your home and luxury possessions, including jewelry, artwork, collectibles, antiques, and custom materials/construction.

Should you disagree with the final report given by the appraisal, you may request a second appraisal, or appeal it by conducting your own expert assessment.

Your coverage needs may change over the years as you redecorate, renovate, or otherwise revamp your home. Your insurance company may require periodic assessments in order to accurately keep your coverage up to date.

An assessment of your estate, as well as a review of your insurance policy, is encouraged at least once every five years.

To read the full article, click here.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]