[et_pb_section fb_built=”1″ _builder_version=”4.0.9″][et_pb_row _builder_version=”4.0.9″][et_pb_column type=”4_4″ _builder_version=”4.0.9″][et_pb_text _builder_version=”4.0.9″]

Around 53% of Americans are saving for retirement in a savings

account. Is that optimal?

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”4.0.9″][et_pb_column type=”4_4″ _builder_version=”4.0.9″][et_pb_text _builder_version=”4.0.9″]

Saving for retirement is tough, and nobody has all the right answers. Everyone is bound to make mistakes sooner or later – but the most important thing is to learn from those blunders and move on.

Unfortunately, though, not all mistakes are created equal. There are some retirement planning missteps that are easy to miss, but could end up being incredibly costly over the long run. And there’s one mistake in particular that can hurt your savings more than you think.

Choose your retirement account wisely

One aspect of retirement planning that’s easy to overlook is where, exactly, you’re stashing your cash. You may be saving in a 401(k), an IRA, a 403(b), or other types of accounts, and each option has its pros and cons.

Another popular retirement fund option is a savings account. In fact, around 53% of Americans have at least a portion of their retirement savings socked away in a savings account, according to a survey from the Certified Financial Planner Board and Morning Consult.

However, saving for retirement in a savings account can be risky, and you could potentially lose money over time. Savings accounts are designed for short-term financial needs, where you may need cash at a moment’s notice. They’re not made for holding your money long-term, and keeping your cash in a savings account for decades could have serious consequences.

The risks of using a savings account

When you stash your long-term savings in a savings account, you could be putting your retirement at risk. Even high-yield savings accounts have interest rates of only around 1% per year, while inflation typically hovers around 2% to 3% per year.

If you’re only keeping a few thousand dollars in a savings account for short-term use, inflation won’t make a significant difference. But if you’re keeping tens or even hundreds of thousands of dollars in this type of account for decades, your money won’t keep up with inflation, and could lose value over time. In other words, your future savings could be worth less than what they are now.

In addition, using a savings account for retirement means you’re missing out on potential stock market growth. Investing in the stock market can be intimidating, but it’s one of the best ways to see significant growth in a relatively short period of time.

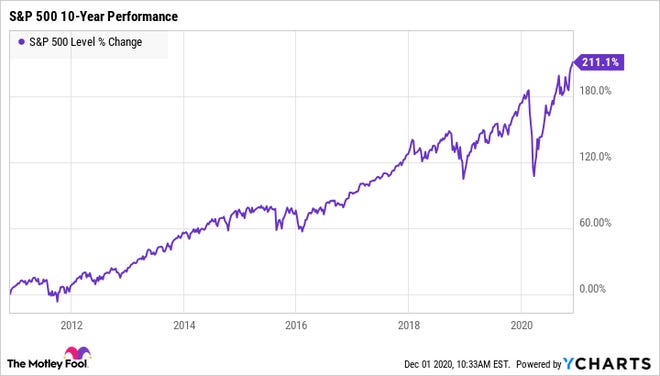

The S&P 500 has experienced a rate of return of around 10% per year, on average, since its inception. Even after the market crashed earlier this year, it still managed to bounce back stronger than ever.

^SPX data by YCharts

Though the market does have its ups and downs, it’s not as risky as it may seem. If you’re keeping your money in a savings account to avoid the risk of investing, you could be losing more than you gain.

Just how much could you miss out on by saving in a savings account? Say you have $10,000 in savings right now. If you were earning a 1% annual return on your money, you’d have approximately $12,200 in savings after 20 years. But if you had invested that money and been earning a modest 7% annual return, you’d have nearly $39,000 saved in that same time period.

Is it time to start investing?

Investing in the stock market can supercharge your savings. And when it comes to saving for retirement, it can actually be less risky than stashing your money in a savings account.

Of course, it’s still a good idea to keep some cash in a savings account for emergencies. The last thing you want is to have to withdraw money from your 401(k) or IRA to cover unexpected expenses. But in general, the more money you’re able to invest, the better off you’ll be in retirement.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]